Rather than undergoing the traditional IPO process which can take months and incur significant fees, a company can merge with a SPAC and become publicly traded within weeks.Īnother benefit of SPACs is that they offer more flexibility for investors. One of the main benefits of SPACs is that they provide a quicker and more cost-effective way for companies to go public. SPACs, also known as Special Purpose Acquisition Companies, have become increasingly popular among investors in recent years.

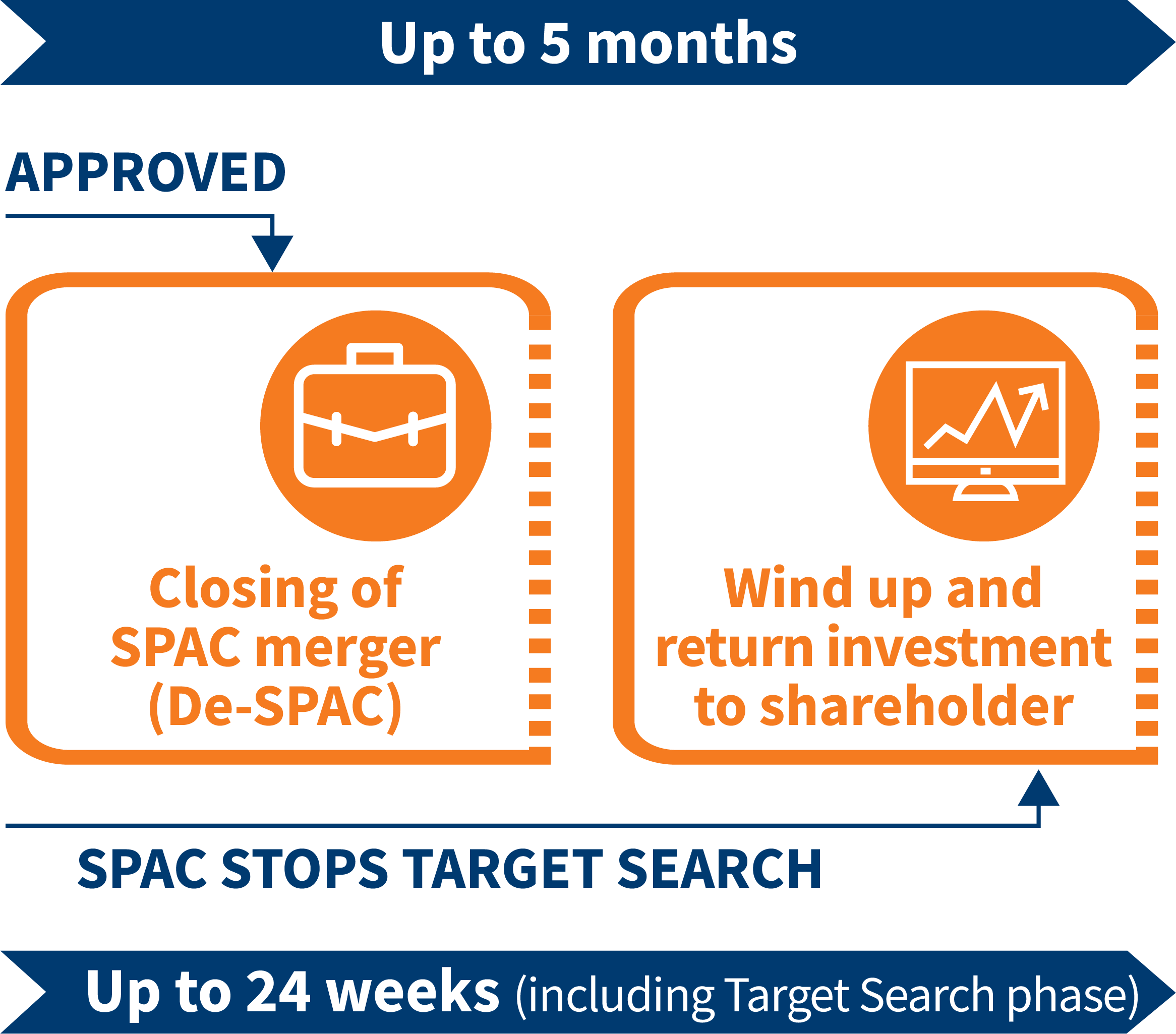

Ultimately, it’s important for companies considering this route to carefully weigh their options and consult with legal and financial advisors before proceeding with de-SPACing. However, there are also potential downsides to de-SPACing such as increased regulatory scrutiny and shareholder lawsuits if performance expectations aren’t met post-merger. It allows for greater flexibility in terms of valuation, dilution, and control compared to traditional IPOs. This process allows companies to bypass some of the traditional initial public offering (IPO) requirements and timeline.ĭe-SPAC transactions have become increasingly popular in recent years as more companies seek alternative ways to go public. Once the merger has been completed and approved by shareholders, the private company becomes publicly traded through the already-listed SPAC. Instead of raising funds to acquire a company, de-SPACing happens when a private company merges with an existing public shell company that was formed as a SPAC. What is de-spac?ĭe-SPAC is the opposite of SPAC or Special Purpose Acquisition Company. While there are certainly risks associated with investing in a SPAC since you’re essentially betting on the management team’s ability to identify and successfully merge with a target company, many view them as an innovative alternative investment option worth considering. In addition, unlike traditional IPOs where shares are priced before going public, SPAC shares are typically sold at $10 per share before any merger takes place. One benefit of investing in a SPAC is that it allows individual investors access to private companies that would otherwise only be available to large institutional investors. If they fail to do so within this timeframe, the SPAC must be liquidated and all funds returned to investors. Upon creating a SPAC, the founders have two years to identify and acquire their target company. Essentially, it’s a blank check company created by investors for the purpose of finding and acquiring an already established private company. SPAC, or Special Purpose Acquisition Company, is a type of investment vehicle that raises funds through an initial public offering (IPO) with the sole purpose of acquiring or merging with another company.

In this blog post, we’ll break down what SPAC and de-SPAC mean, their benefits, and ultimately help you decide which option is best for you.

As a procurement specialist, it’s important to understand these differences in order to make an informed choice. While they sound similar, there are key differences between the two that can greatly impact your decision. What Is The Difference Between Spac And De-Spac?Īre you looking to invest in a company or take your own public? If so, you may have come across the terms SPAC and de-SPAC.

0 kommentar(er)

0 kommentar(er)